Last updated: February 2024 / 831310 o'block

Are halvings sure to result in bull runs/all-time maximums on the price chart?

No. Bitcoin as an investment asset is new and nothing is for certain.

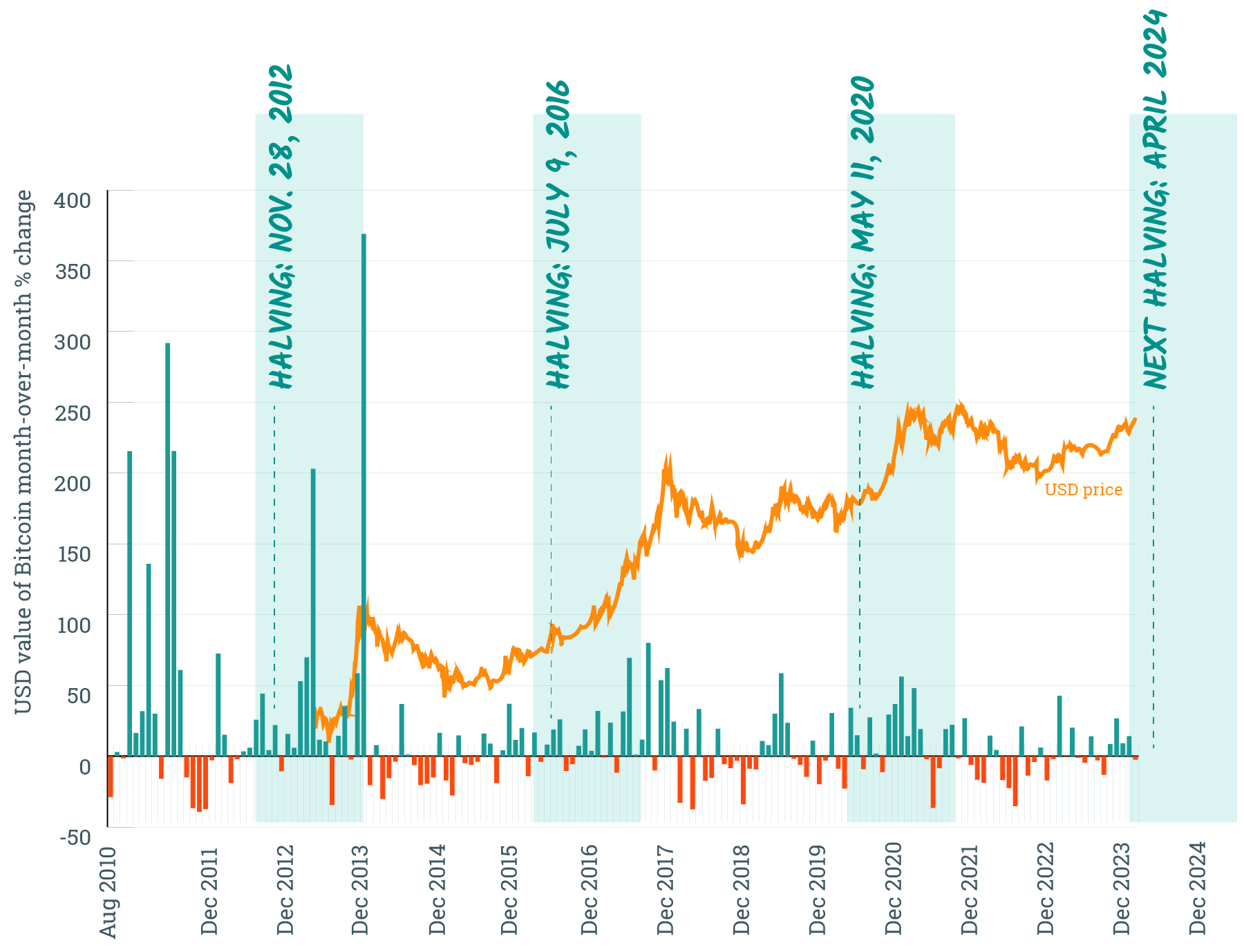

That said, historical data show a surge in price of bitcoin after the halvings. There are a few good reasons to assume that the price will go up after the future halving events:

Bitcoin miners are an essential part of the network. For their operations, they need hardware and electricity, for which they pay by selling the bitcoin they mine.

As the name implies, the halving cuts in half the supply of new bitcoin going forward. At the time of writing(just before the 2024 halving) for each block mined the block reward is 6.25 btc, whereas after the halving it will be 3.125 btc per block mined. On average, a Bitcoin block is mined every 10 minutes - so about 144 each day. At 3.125 btc/block, that means that each day, each day 450 bitcoin fewer will be mined and sold. Assuming no changes to the demand for bitcoin, everyone who would have bought those 450 bitcoins before, will now with their purchasing power be competing for the remaining 450 bitcoins that will be mined, pushing the price upward in the process.

Now that the halving effect has been widely recognised, there will inevitably be people who will, before the halving even happens, start to buy and hold bitcoin waiting for the price to rise. This is additional removal of supply from the market that pushes the price upward even more. As the increase in price becomes news in the media, it creates an additional spike in the price and causes it to become very volatile as inexperienced buyers crowd in and more experienced speculators start to sell as they predict the price to eventually return to more sustainable levels.

The Bitcoin cycle appears to coincide with the election cycle in the US. Whether it's been deliberately designed so we don't know, but we do know that pre-election tends to be the period when politicians try to keep the public happy - including increasing availability of money - and some of that money sloshing around inevitably flows into Bitcoin, raising demand and so the price.

FAQ: If the halving is an event known in advance, isn't it already priced in at the time of a halving?

Answer: It is partly priced in. In the cycles so far, the 17 months prior to a halving have seen significant increases in price.

There are, however, reasons why it is not fully priced in:

***

If you are trading bitcoin, you should keep in mind that the excessive price levels as are seen during the spikes in price of Bitcoin are unsustainable over a long time and it's reasonable to expect the price to slump down in months or years after. Additionally, the price of Bitcoin is affected by other factors - global economic and financial conditions, changes in price of energy, changes in regulation or technology - and the resulting movements of price can be sudden and unpredictable.

As halvings happen roughly once every 4 years, there are reasons to expect a big bull run once every 4 years. It takes skill and luck to time the exact all-time high in price, so be careful if you try for it. If you miss it, you may end up selling your bitcoin out of fear when its value is much less, or having to wait a whole 4-year cycle for it to return where it makes sense to sell.

To avoid making wrong decisions when your emotions run high, it's a good idea to have a long-term plan and stick to it.