Last updated: April 2023 / 785270 o'block

There will only ever be just under 21 million bitcoin. Most of them have already been mined. As per the protocol, the supply of new bitcoins is predictable and dwindling, and the total amount of bitcoin limited.

What if that’s not enough for everyone?

It will be enough. A single bitcoin can be divided into 100 000 000 smaller untis called satoshis. If that’s ever not enough, even smaller units can be introduced. Although the total number of bitcoin is limited, the amount of units that can be used for transactions is not.

But if you keep dividing the bitcoin, isn’t that the same as the governments issuing more Fiat dollars or other Fiat currency?

No. The difference is that the value of what you own won’t be diluted away. Dividing units into subunits does not change the value of the initial units.

To understand this, imagine that a dollar, instead of a paper note, is a vessel - a bucket - that 'holds' an amount of products or services you can buy with it - some bread, or some fruit, or some ice cream.

So in this story: buck corresponds to a bucket, and the value of products or services you can get for it will be ice cream.

At any given moment, there is only so much value (products and services) in an economy, and that total value is divided into all the buckets that people own.

If the number of bucks is constant but the amount of products and services is higher - you get more for your buck.

If the number of bucks grows, given a constant amount of product and services - you get less for your buck.

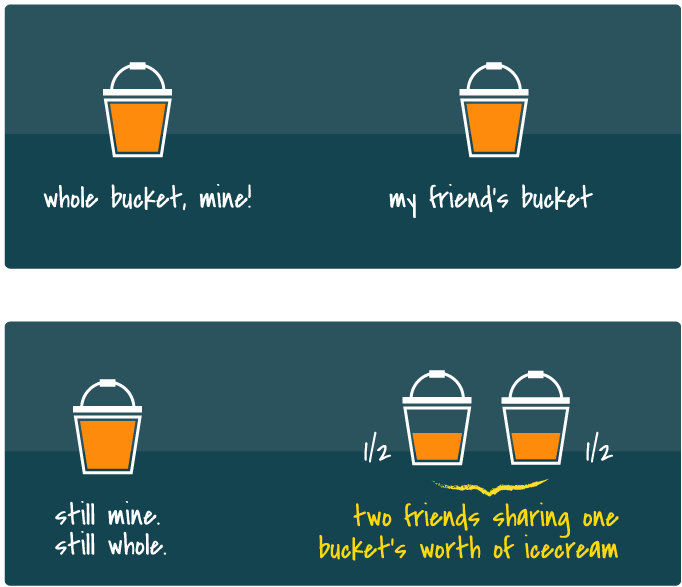

Let's say there are only 21 million buckets of ice cream in the world. You buy one and decide to save it in your freezer. Your friend buys a bucket and decide to split it with another friend. It doesn't affect you: you still have a whole bucket, and your friends will have half a bucket of ice cream each.

If three more people arrive and they decide to buy and split a third bucket of ice cream, it doesn't affect you; your entire bucket of ice cream is still safe in your freezer. You don't care what people are doing with their buckets because yours is safe where you put it. They can share theirs, use it to trade, pay each other for work with it; none of it matters to you.

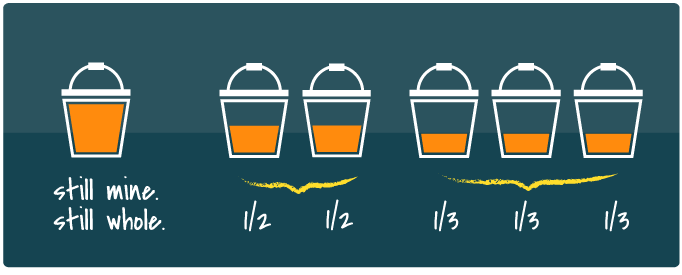

With Fiat, it's a different story. When money supply grows, all else equal, its purchasing power decreases. Its as if someone grabs your bucket from your freezer, scoops out some of your ice cream, puts it in a newly created bucket and passes it to the next person claiming it's a full bucket. You and the other person both end up with a bucket - but there's now less ice cream in each bucket. In other words, the value of products and services you can get for your buck is frequently diminished.

***

Some things to keep in mind:

** For purposes of keeping this explanation easy to grasp, it's looking at money supply. It is assuming no changes in supply of goods and services that will naturally occur in any real-life economic system, that affect the value you can receive in return for your money. Real life is complex, we're just isolating a single aspect of it here so we can understand it easily.

** Similarly, we're not here to debate the merits or downsides of any level of monetary inflation. Until this question is subject to public debate and a democratic vote, all we can do about inflation is understand it and find ways to live with it.

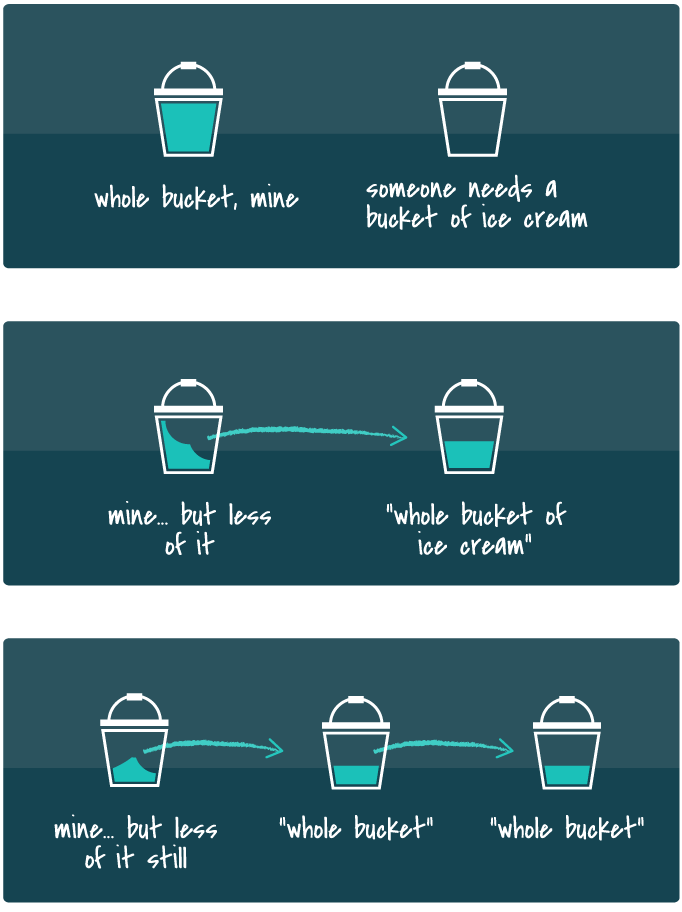

Graphical abstract: for when you just need a quick overview or reminder - same stuff as above, just all in one image.